Table of Contents

ToggleIntroduction

What is Commercial Real Estate?

Commercial real estate (CRE) refers to properties that are used exclusively for business purposes. These properties are leased to tenants who operate businesses and generate income. Types of commercial real estate include:

-

Office Buildings: Spaces for businesses, ranging from small offices to large corporate headquarters.

-

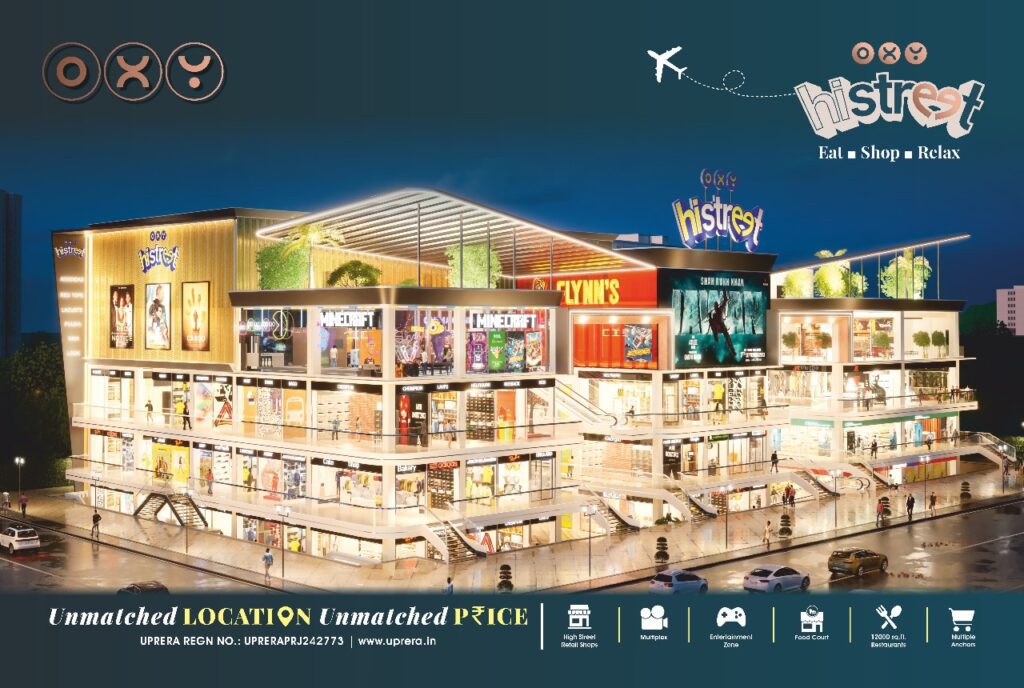

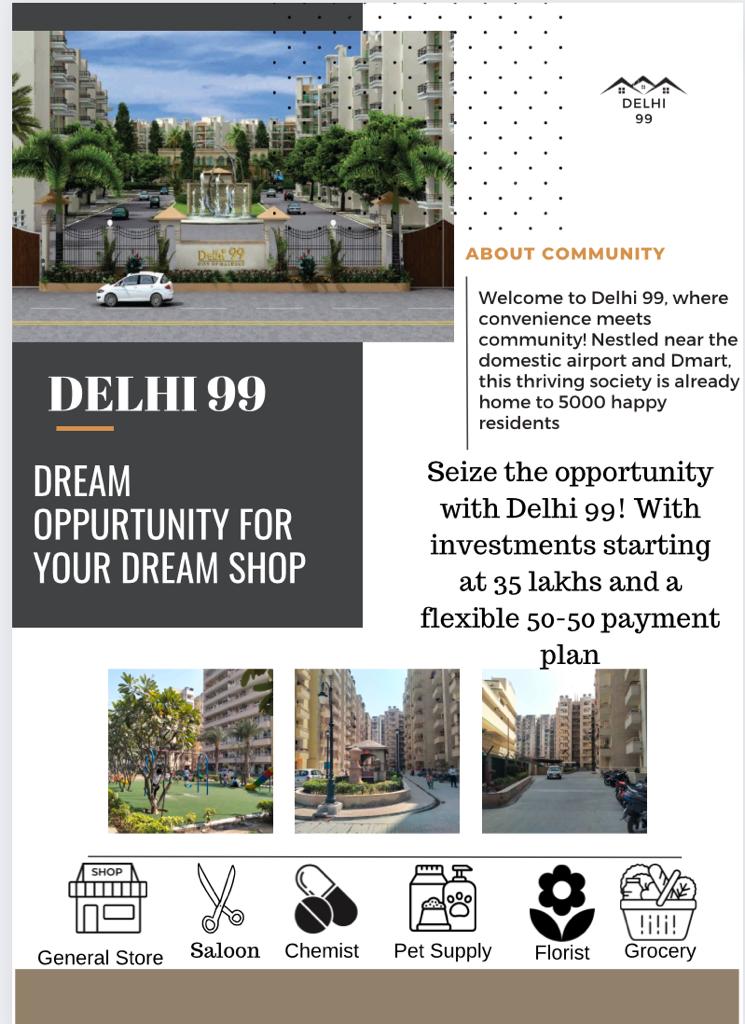

Retail Properties: Shopping centers, standalone stores, and malls.

-

Industrial Properties: Warehouses, manufacturing plants, and distribution centers.

-

Multi-Family Units: Apartment buildings with multiple rental units.

-

Mixed-Use Developments: Properties that combine residential, commercial, and retail spaces.

Why Invest in Commercial Real Estate?

-

Higher Returns: CRE often offers better returns compared to residential real estate, thanks to longer lease terms and higher rental income.

-

Stable Income: Commercial leases typically last several years, providing a stable cash flow. Businesses tend to be more reliable tenants than individual renters.

-

Tax Benefits: Investors can take advantage of various tax deductions, including depreciation, maintenance costs, and property expenses.

-

Value Appreciation: As urban areas grow, commercial properties can appreciate significantly over time, adding to your investment’s value.

Key Considerations When Investing in Commercial Real Estate

-

Location: A prime location is essential for attracting tenants. Look for areas with high foot traffic, accessibility, and proximity to amenities.

-

Market Research: Understand local market trends, vacancy rates, and economic indicators that affect demand for commercial properties.

-

Zoning Laws: Ensure the property complies with local zoning regulations for your intended use, whether it’s retail, office, or industrial.

-

Property Management: Consider whether you will manage the property yourself or hire a management company. Effective management can significantly impact your investment’s success.

Current Trends in Commercial Real Estate

-

Remote Work Impact: The rise of remote work has changed the demand for office space. Many businesses are downsizing or reconfiguring their office environments.

-

E-commerce Growth: The shift towards online shopping is increasing demand for industrial spaces, particularly warehouses and distribution centers.

-

Sustainability: Eco-friendly buildings and sustainable practices are becoming a priority for tenants and investors alike.

-

Mixed-Use Developments: These are gaining popularity as they create vibrant communities that combine residential, commercial, and recreational spaces.

Conclusion

Commercial real estate offers a wealth of opportunities for investors looking to diversify their portfolios and achieve financial growth. With the right knowledge and resources, you can make informed decisions that will benefit you in the long run.