Table of Contents

ToggleIntroduction

Investing in real estate can be a lucrative venture, and there are several types of investment properties to consider, each with its own set of opportunities and challenges:

1. Single-Family Homes

-

Description: A property designed for one family or household.

-

Pros: Easier to manage, typically less expensive to purchase and maintain.

-

Cons: Often generates less rental income compared to multi-family properties.

2. Multi-Family Homes

-

Description: Properties with multiple separate units, such as duplexes, triplexes, and fourplexes.

-

Pros: Multiple income streams from one property, potential for higher rental yields.

-

Cons: More complex management, higher initial investment and maintenance costs.

3. Apartment Buildings

-

Description: Larger buildings with multiple rental units.

-

Pros: Significant rental income potential, economies of scale in management and maintenance.

-

Cons: Higher purchase price, more intensive management, and potentially more regulatory challenges.

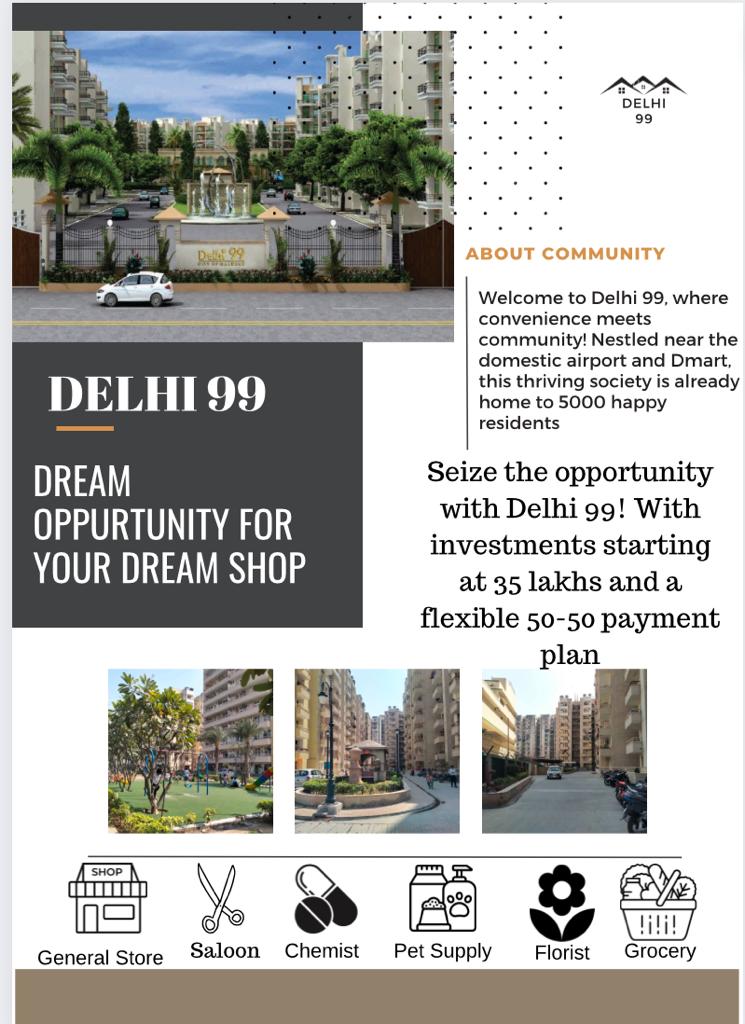

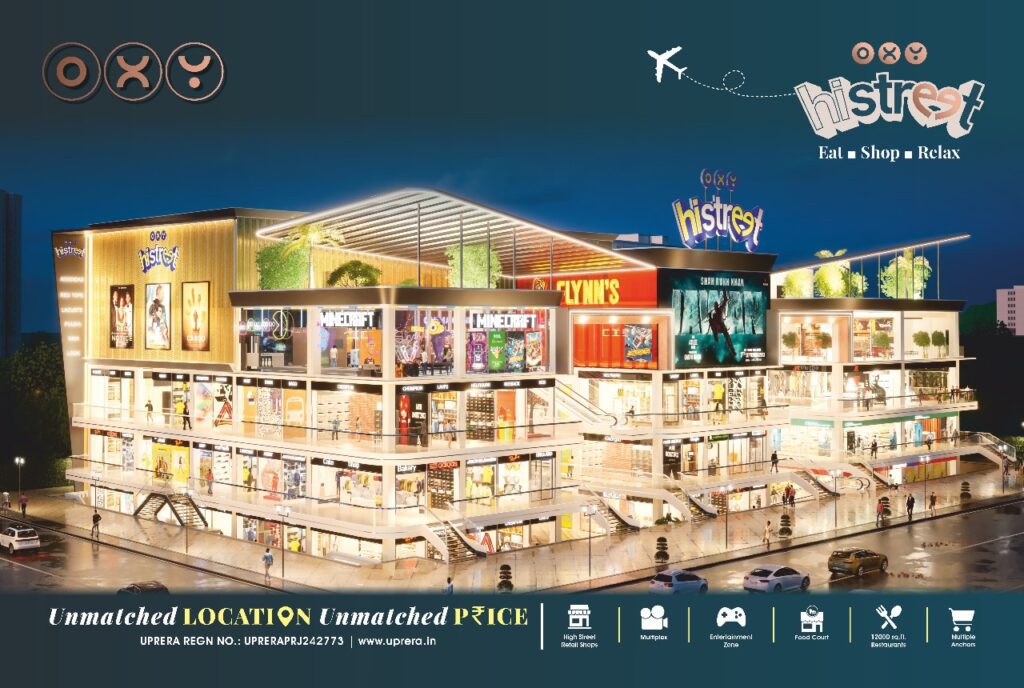

4. Commercial Real Estate

-

Description: Properties used for business purposes, including office buildings, retail spaces, and industrial properties.

-

Pros: Often long-term leases and potentially higher returns, diversification of rental income.

-

Cons: Higher risk due to economic cycles affecting businesses, more complex leasing agreements.

5. Vacation Rentals

-

Description: Properties rented out on a short-term basis, often through platforms like Airbnb or Vrbo.

-

Pros: Potentially high rental income during peak seasons, flexibility in personal use.

-

Cons: Seasonal income fluctuations, higher management demands, and more frequent tenant turnover.

6. Real Estate Investment Trusts (REITs)

-

Description: Companies that own or finance income-producing real estate across various sectors and are traded on major exchanges.

-

Pros: Liquidity, diversification, and professional management without the need for direct property ownership.

-

Cons: Market volatility, potential for lower returns compared to direct property investment.

7. Raw Land

-

Description: Undeveloped land purchased for future development or investment.

-

Pros: Potential for significant appreciation, less initial management.

-

Cons: No immediate income, ongoing property taxes, and development risks.

8. Fix-and-Flip Properties

-

Description: Properties bought at a lower price, renovated, and then sold for a profit.

-

Pros: Potential for substantial profit, ability to add value through improvements.

-

Cons: High-risk, requires significant upfront capital and expertise in renovations.

9. Real Estate Crowdfunding

-

Description: Investing in real estate projects through online platforms with other investors.

-

Pros: Allows access to real estate investments with lower capital, diversification.

-

Cons: Risks associated with specific projects and platforms, less control over the investment.

10. Student Housing

-

Description: Properties rented to students, often near colleges or universities.

-

Pros: Consistent demand in college towns, potential for higher rental rates.

-

Cons: Potentially higher turnover, property management challenges with young tenants.

Each type of investment property has its own risk profile, management requirements, and potential for returns. Your choice will depend on your investment goals, risk tolerance, and resources.